, , a low introductory rate or a way to build positive credit history through responsible use, we have a credit card for you.

Special offer for new Prestige credit cards

Your rewards [2] add up fast: 3% on dining and entertainment purchases, 2% on gas & grocery purchases and 1% on all other purchases. [3]

Earn up to 4% when you register for Rewards Multiplier [4] and maintain certain balances in your Regions checking and other deposit accounts.

Earn 1.5% Cash Rewards [2] on purchases [3] with no annual fee [5] with the Cash Rewards Visa® Signature Credit Card.

Earn up to 3% cash back on everyday purchases. [3] Earn up to 4% when you register for Rewards Multiplier. [4]

[2] points per $1 spent on select purchases [3] with the Prestige Visa® Signature Credit Card.

Take advantage of our longest standard introductory interest rate [5] to help you manage your finances with the Life Visa® Credit Card.

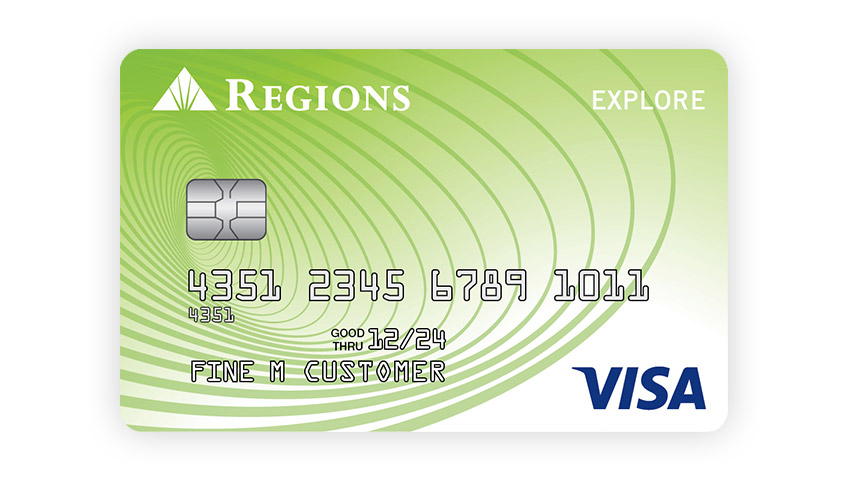

Responsible use of the Explore Visa® Credit Card can help you build a positive credit history. [6]

Compare our credit cards side by side or use our rewards calculator to find the right rewards card for you.

View our business credit cards

Use our balance transfer calculator

Learn more about credit card rewards

Answer questions to find the right product

With a Regions Visa® contactless chip credit card, you can tap your card to pay for everyday purchases.

Control how your Regions credit cards are used by blocking certain types of transactions with Regions LockIt.

Offers may vary depending on where you apply, for example online or in a branch, and can change over time. Review offer details carefully before you apply; all offers are subject to important terms and conditions.

Regions Rewards programs allow you to earn rewards for qualifying purchases on certain Regions credit cards. APRs on credit cards with rewards may be higher than those without rewards.

Rewards are not earned for any purchases of items that can be traded right away for cash (such as wire transfers, money orders, traveler’s checks, lottery tickets or casino chips), or any other cash advances, balance transfers, fees, interest charges, or unauthorized or fraudulent purchases.

Additional cash back on entertainment, dining, gas and grocery store purchases are awarded based on the merchant category code (MCC) assigned to the merchant where you made the purchase. Regions does not control which MCC a merchant is assigned; it is based on the primary good or service the merchant sells. If a merchant’s MCC does not match the MCC for one of these categories, 1% cash back will be awarded for the purchase. Learn more about the Prestige card special offer.

This Program is a bonus available in connection with certain Regions deposit accounts. The Annual Percentage Yield (APY) for currently offered interest-bearing consumer deposit accounts whose balances are used to calculate the Total Average Deposit Balance is available at www.regions.com. Check rates and APYs for LifeGreen Preferred Checking, LifeGreen Savings, Savings, Savings for Minors, Now Savings, Money Market, Premium Money Market, and IRAs. Check rates and APYs for CDs.

Learn more about the Annual Percentage Rates (APRs) and certain fees that apply to all credit cards except the Explore Visa Credit Card.

Learn more about the Annual Percentage Rates (APRs) and certain fees that apply to the Explore Visa Credit Card.